Understanding property taxes is crucial for homeowners and potential buyers in Cartersville, Georgia. This comprehensive guide will walk you through everything you need to know about property taxes in this vibrant city, from calculation methods to payment options and potential savings opportunities.

Cartersville Property Tax Administration: Who’s in Charge?

The Bartow County Tax Commissioner’s office, under the leadership of Steve Stewart, is responsible for property tax collection in Cartersville. Here’s what you need to know:

- Location: 135 W Cherokee Ave, Suite 217A, Cartersville, GA 30120

- Office Hours: Monday – Friday, 8:00 am – 5:00 pm

- Contact: (770) 387-5111

How Are Property Taxes Calculated in Cartersville?

Property taxes in Cartersville are based on the assessed value of your property. Here’s a breakdown of the process:

- Property Assessment: Your property’s value is assessed, typically at a percentage of its fair market value.

- Millage Rate Application: The county applies a millage rate to the assessed value.

- Tax Calculation: Your property tax is calculated by multiplying the assessed value by the millage rate.

While specific rates may vary year to year, Cartersville’s property taxes are generally competitive compared to other Georgia cities.

When and How to Pay Your Cartersville Property Taxes

Staying on top of your property tax payments is crucial to avoid penalties. Here are your payment options:

- Online Payments: The most convenient method, available 24/7 through the county’s secure website.

- In-Person Payments: Visit the Tax Commissioner’s office during business hours.

- Mail: Send a check or money order to the office address.

Pro Tip: Set up reminders for due dates to avoid late fees.

Understanding Property Tax Exemptions in Cartersville

Cartersville offers several property tax exemptions that could significantly reduce your tax bill:

- Homestead Exemption: Available for primary residences.

- Senior Citizen Exemption: For homeowners aged 65 and older.

- Disabled Veteran Exemption: For qualifying veterans with service-connected disabilities.

- Surviving Spouse Exemption: For un-remarried spouses of U.S. service members, peace officers, or firefighters killed in the line of duty.

Contact the Tax Commissioner’s office for detailed eligibility requirements and application procedures.

The Property Tax Appeal Process in Cartersville

If you believe your property’s assessed value is inaccurate, you have the right to appeal. Here’s a general outline of the process:

- File a written appeal with the Bartow County Board of Assessors.

- Provide evidence supporting your claim (e.g., recent appraisals, comparable sales data).

- Attend a hearing if necessary.

- Receive a decision from the Board.

Note: Appeal deadlines are strict, so act promptly if you disagree with your assessment.

Factors Affecting Property Taxes in Cartersville

Several factors can influence your property tax bill:

- Property Improvements: Renovations or additions can increase your property’s value and, consequently, your taxes.

- Changes in Local Budget: City and county budget needs can affect millage rates.

- Market Fluctuations: Changes in the real estate market can impact property values.

- Special Assessments: Fees for local improvements (e.g., new sidewalks) may be added to your tax bill.

Tips for Managing Your Cartersville Property Taxes

- Review Your Assessment Annually: Ensure it accurately reflects your property’s value.

- Apply for All Eligible Exemptions: Don’t miss out on potential savings.

- Consider Tax Implications of Home Improvements: Weigh the benefits against potential tax increases.

- Budget for Property Taxes: Set aside money monthly to avoid a large annual payment.

- Stay Informed: Attend local government meetings to understand factors affecting property taxes.

Cartersville Property Taxes in Context

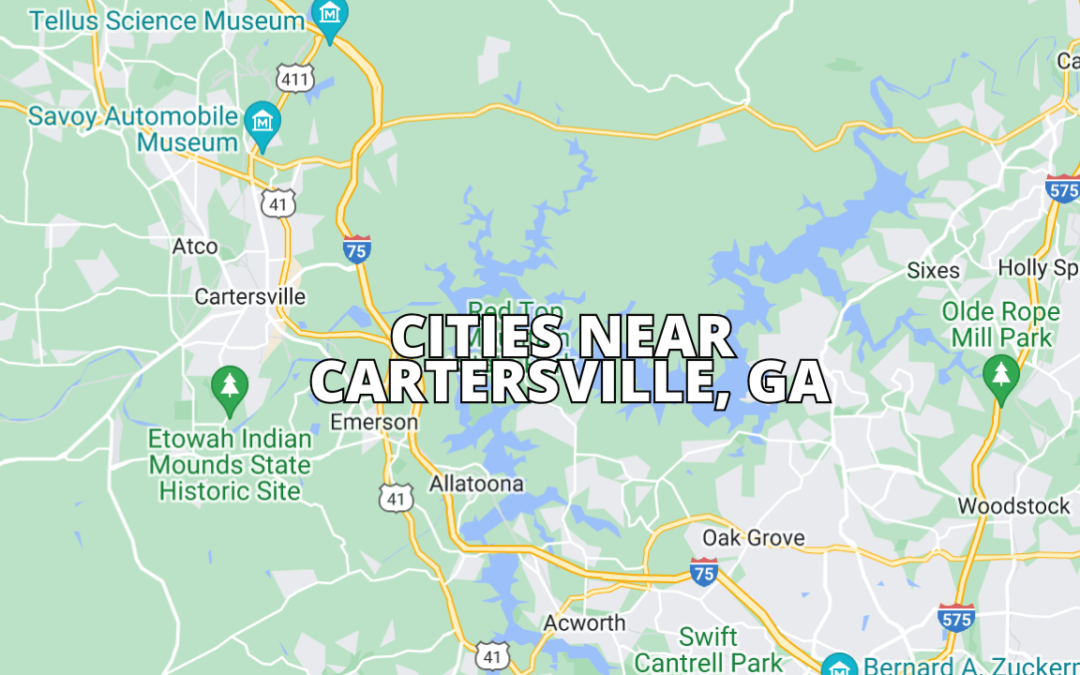

Compared to national averages, Cartersville’s property taxes are generally competitive. However, rates can vary significantly based on specific neighborhoods and property types. When house hunting, consider the long-term tax implications of different areas within Cartersville.

Resources for Cartersville Property Owners

- Bartow County Tax Commissioner’s Website: For forms, payment options, and updates.

- Georgia Department of Revenue: For state-level property tax information.

- Local Real Estate Professionals: For insights on property values and tax trends in specific neighborhoods.

Understanding your property taxes is an essential part of homeownership in Cartersville. By staying informed and proactive, you can better manage your finances and make the most of your investment in this charming Georgia community.

Remember, for the most current and detailed information, always consult with the Bartow County Tax Commissioner’s office or a qualified local tax professional.

Considering buying a home in Cartersville, Georgia?

Take the first step today! Book a call with our real estate team today!

Greg Goad is a seasoned Realtor® based in Canton, GA, serving clients throughout Greater Atlanta and Northwest Georgia, including Cobb and Cherokee counties. As the founder of Goad Home Partners and an Elite Agent with Real Broker, LLC, Greg brings over 9 years of real estate expertise, more than $55 million in individual sales, and a reputation for integrity and client dedication.

Known for his deep Cartersville, GA knowledge, responsive service, and approachable professionalism, Greg expertly guides buyers, sellers, and relocating families through every step of the real estate process. Clients consistently praise his commitment, market insight, and genuine care, making him a trusted choice for anyone looking to buy or sell property in and around Cartersville, GA.