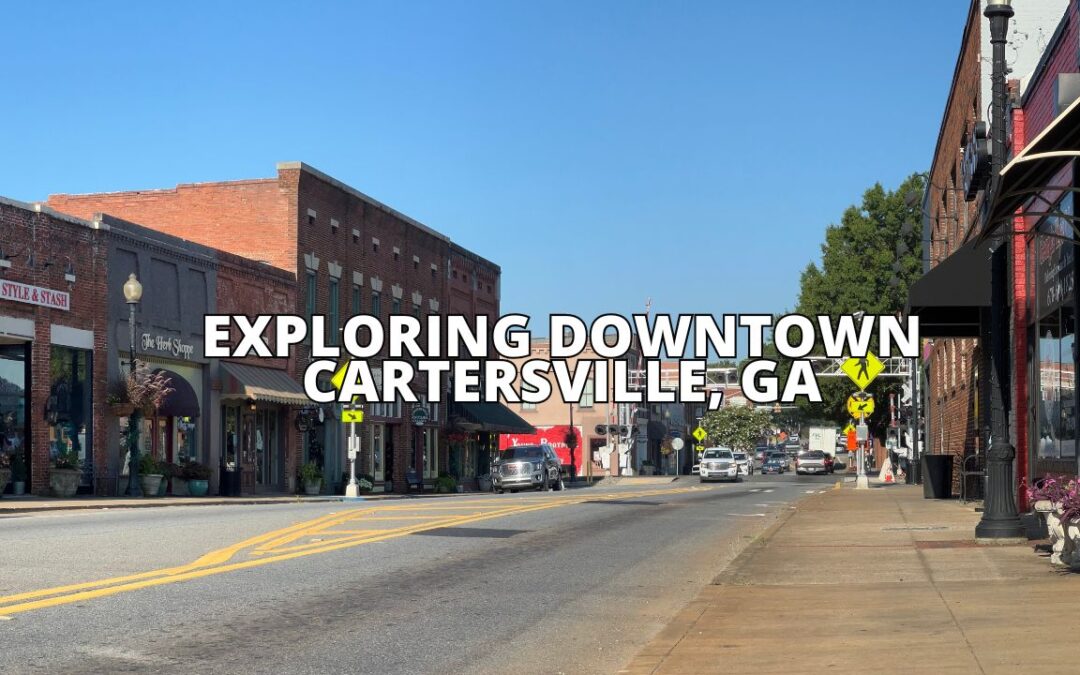

Learn how to buy a home in Cartersville, GA

Buying a home in Cartersville, GA, can be an exciting journey. This charming city offers a range of housing options, making it essential to know what to look for. Understanding the local real estate market, identifying neighborhoods, and securing financing are key steps in making a successful purchase.

With numerous homes available, potential buyers should concentrate on their specific needs, such as proximity to schools, work, and amenities. Researching market trends and the prices of homes helps set realistic expectations.

Financing is one of the most crucial aspects of buying a home. Many options exist, from traditional mortgages to special first-time buyer programs. By gathering information and getting pre-approved, buyers can streamline their home search and make informed decisions.

Understanding the Cartersville GA Real Estate Market

The real estate market in Cartersville, GA, is experiencing notable changes. As of June 2024, home prices increased by 18.9% compared to the previous year, with a median price of $355,000. Homes sell relatively quickly, averaging just 16 days on the market.

In July 2024, 97 homes were sold in Cartersville. The data shows that:

- 69% sold within 30 days

- 25% sold between 30 to 90 days

- 6% took over 90 days to sell

This fast-paced market suggests that buyers need to act quickly to secure a home.

Buyers should pay attention to market trends. For example, the median listing price in March 2024 was recorded at $387,300, indicating a 12.3% increase year-over-year.

When searching for homes, it’s essential to consider various home types. Each type may have different price points and selling times that can impact a buyer’s decision.

Networking with local real estate agents can provide valuable insights. They offer knowledge on pricing, negotiations, and market specifics that can aid in making informed decisions.

Understanding these factors is crucial for anyone looking to buy a home in Cartersville. Keeping up with market changes helps buyers make the best choices tailored to their needs.

Assessing Your Housing Needs and Budget

When buying a home in Cartersville, GA, assessing one’s housing needs is crucial. This process involves understanding personal requirements and financial limits.

Start with Needs:

- Number of Bedrooms: Determine how many bedrooms are necessary for family or guests.

- Location: Consider proximity to work, schools, and amenities.

- Type of Home: Decide between single-family homes, condos, or townhouses.

Next, evaluate the budget.

Key Budget Factors:

- Down Payment: Calculate based on home price. A 3% down payment on a $250,000 home is $7,500, while 20% is $50,000.

- Monthly Expenses: Include mortgage, property taxes, insurance, and maintenance costs.

- Save for Unexpected Costs: Reserve funds for repairs and emergencies.

Using a Calculator:

A mortgage affordability calculator can help in estimating monthly payments. This includes different interest rates and loan terms.

Review Finances:

- Credit Score: Check the score to understand borrowing ability.

- Income Stability: Ensure consistent income to manage monthly mortgage payments.

This assessment helps create a realistic plan to find the right home in Cartersville that fits both needs and budget.

Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is an important step in the home buying process. It shows sellers that a buyer is serious and capable of securing a loan.

To begin, a buyer should gather necessary documents. These typically include:

- Proof of income (pay stubs, tax returns)

- Employment verification

- Bank statements

- List of debts and assets

Next, the buyer can choose a lender. Researching different lenders can help find the best rates and terms. Comparing offers can save money over time.

Once a lender is chosen, the buyer submits a mortgage application. The lender will review the documents and verify the buyer’s financial information. This may include checking credit scores and assessing debt-to-income ratios.

The lender then provides a pre-approval letter if everything checks out. This letter states how much the buyer can borrow, which helps in determining a budget.

Having a pre-approval makes home purchasing smoother. It allows the buyer to make offers confidently, knowing their financing is secure. This step can even speed up the closing process once a home is found.

For detailed guidance, potential buyers can check resources like Zillow’s guide or NerdWallet’s article.

Searching for Properties

When searching for a home in Cartersville, GA, individuals have several reliable online platforms to explore. Popular websites include:

- Zillow: Offers 412 homes for sale, along with photos and sales history.

- Trulia: Lists 411 homes and provides open house information and neighborhood research.

- Realtor.com: Features 529 homes with a median listing price of $350,000.

- Redfin: Highlights specific properties, including details on size and amenities.

Using these platforms, buyers can filter their searches by price, size, and other preferences. For example, filtering by price range helps narrow down suitable options without feeling overwhelmed.

It is also helpful to attend open houses. This allows potential buyers to see the property in person and interact with the seller or the agent. A visit can provide insights that photos alone may not convey.

One key tip is to note the characteristics of each home that appeal to them. Keeping a list can simplify comparisons later.

Furthermore, researching the neighborhood is essential. Looking into local schools, parks, and shopping can influence a buyer’s decision.

Staying organized during the property search will lead to a more efficient home-buying experience.

Property Viewing and Evaluations

When buying a home in Cartersville, GA, property viewing and evaluations are crucial steps. This process allows buyers to get a real sense of the home’s condition and features.

First, buyers should attend open houses or schedule private viewings. Taking notes during these visits can be very helpful. Here are some key points to evaluate:

- Structural Condition: Look for cracks in walls and ceilings.

- Plumbing Issues: Check for leaks under sinks and around toilets.

- Electrical Systems: Test lights and outlets to ensure they work.

- Neighborhood: Observe the surroundings and amenities nearby.

It is also wise to bring someone knowledgeable, like a trusted friend or a real estate agent, to help spot potential issues.

After viewings, getting a home inspection is essential. Professional inspectors can identify hidden problems, such as:

- Roof Condition

- Pest Infestation

- HVAC Systems

These evaluations are important for making an informed decision. Buyers may also want to compare multiple properties to determine which offers the best value.

A thorough evaluation process can help buyers avoid costly surprises later. They should consider all aspects before making an offer on a property.

Making an Offer

Making an offer on a home in Cartersville, GA involves understanding the contract details and employing effective negotiation strategies. This process can significantly impact the chances of a successful purchase.

Understanding the Contract

When making an offer, the buyer must thoroughly understand the sales contract. This document outlines the terms of the sale, including the purchase price, closing date, and any contingencies. Buyers should pay special attention to contingencies, which may include home inspections or financing approval.

Important elements to review in the contract include:

- Purchase Price: The amount the buyer is offering.

- Earnest Money: A deposit that shows seriousness, typically 1-3% of the purchase price.

- Contingencies: Conditions that must be met for the sale to proceed.

Buyers must ensure all terms align with their financial situation and expectations before signing.

Negotiation Strategies

Effective negotiation can lead to a better deal. Buyers should start with a competitive offer based on comparable homes in the area. Researching recent sales can provide insight into what is reasonable.

Key negotiation strategies include:

- Make a Strong Offer: An offer close to the asking price may show seriousness.

- Be Flexible: Willingness to adjust closing dates or include personal items can improve chances.

- Communicate Clearly: Keeping the lines of communication open with the seller can foster a positive negotiation environment.

Using these strategies, buyers in Cartersville can position themselves favorably during the offer process.

Home Inspection and Appraisal

A home inspection and appraisal are critical steps in the home buying process in Cartersville, GA. They ensure that the buyer is making a sound investment by identifying any issues in the property and determining its fair market value.

Scheduling Inspections

When buying a home, scheduling a home inspection is essential. It is typically done once the buyer’s offer is accepted. Buyers should look for qualified inspectors in Cartersville. Several options include companies listed on platforms like Zillow or Yelp.

Once a suitable inspector is found, the buyer should coordinate a time that works for both parties. Inspectors will evaluate the home’s major systems, such as plumbing, electrical, and structural integrity. A thorough inspection usually takes 2-3 hours, depending on the home size.

Interpreting Inspection Results

After the inspection, the buyer will receive a detailed report. This report outlines any issues discovered during the inspection. Common findings may include roof damage, plumbing leaks, or electrical problems.

Understanding these findings is crucial. Buyers should prioritize issues based on severity and cost. Major concerns might warrant negotiation with the seller for repairs or price reductions. A good home inspector will offer guidance on which repairs are urgent and which can wait.

Dealing With Appraisal Outcomes

An appraisal follows the inspection. A licensed appraiser evaluates the home’s market value based on several factors such as location, condition, and comparable sales. The appraisal protects the lender and buyer by ensuring the home is worth the loan amount.

If the appraisal comes in lower than the agreed price, the buyer has options. They can negotiate with the seller for a lower price or provide additional funds to cover the difference. It’s also possible to challenge the appraisal if significant facts were overlooked. Understanding these outcomes is vital for making informed decisions in the purchasing process.

Navigating the Closing Process

The closing process is a crucial step in buying a home. It involves finalizing the sale and transferring ownership. Here are the key steps to navigate this process smoothly:

-

Review the Closing Statement

This document outlines all the costs associated with the sale. Buyers should check for accuracy and ensure all agreed-upon terms are met. -

Complete the Loan Documents

Buyers must finalize their mortgage paperwork. This includes signing the loan agreement and any other required documents. -

Conduct a Final Walk-Through

Prior to closing, buyers should inspect the home one last time. This ensures that the property is in the agreed condition. -

Arrange for Home Insurance

Buyers need to secure homeowners insurance before closing. This protects against damages or losses after taking ownership. -

Funds and Payments

Buyers should prepare for the payment of closing costs. This typically includes fees for the loan, title insurance, and any taxes. -

Sign the Paperwork

During the closing meeting, buyers will sign several documents. This concludes the transaction and transfers ownership. -

Receive the Keys

After all documents are signed and funds are transferred, buyers will receive the keys to their new home.

Completing these steps ensures a successful closing experience. For a detailed guide, check out Breaking Down the House Closing Process.

Moving In and Post-Purchase Considerations

Moving into a new home in Cartersville, GA can be exciting. After closing the deal, several important steps must be taken to ensure a smooth transition.

Transfer Utilities:

Before moving in, it’s essential to transfer utilities like water, electricity, and gas to the new address. This should be done a few days before the move.

Changing Address:

Updating the mailing address is crucial. This includes notifying the post office and important institutions such as banks, insurance companies, and employers.

Inspecting the Home:

After the move, a thorough inspection of the home is beneficial. Look for any repairs needed or issues that were not addressed before buying.

Security Measures:

Consider changing the locks on all doors for safety. New homeowners should also check the security system or consider installing one if needed.

Settling In:

Unpacking gradually can make the process less overwhelming. Setting up priorities and designating specific areas for boxes can help in organizing the new space.

Post-Purchase Checklist:

Creating a checklist can help in managing tasks after moving in. This may include tasks like setting up internet service and scheduling maintenance.

Finally, joining local community groups can help new residents connect and get to know Cartersville better.

Frequently Asked Questions

Buying a home in Cartersville, GA, can raise several common questions. This section addresses key inquiries about the buying process, home costs, and specific market information.

What are the steps involved in buying a house for the first time in Georgia?

The first-time home buying process in Georgia includes several important steps. They start with determining a budget and getting pre-approved for a mortgage. Next, prospective buyers should work with a real estate agent, search for homes, make an offer, and complete inspections before closing the deal.

What is the average cost of a home in Cartersville, GA?

The average cost of a home in Cartersville, GA is approximately $364,310. This figure reflects the average sale price over the last year and indicates a diverse real estate market with various options for buyers.

How can I find homes for sale by owner in Cartersville, GA?

To find homes for sale by owner in Cartersville, GA, buyers can use online platforms and local classifieds. Websites specifically detailing listings without agents are also helpful. Local community boards can feature postings by owners looking to sell directly.

What are the typical property prices for new homes in Cartersville, GA?

New homes in Cartersville, GA, often start around $301,900. Prices can vary based on the size, location, and features of the homes. New developments in particular can offer different pricing tiers based on upgrades and community amenities.

What are the advantages of buying a townhome in Cartersville, GA over a single-family house?

Buying a townhome in Cartersville, GA, can provide several advantages. Townhomes often require less maintenance than single-family homes, making them appealing for busy buyers. They also offer a community feel and may come with shared amenities.

What is the cost of living in Cartersville, GA compared to the rest of Georgia?

The cost of living in Cartersville, GA, is generally aligned with the state average. However, living in Cartersville can be more affordable than in larger cities like Atlanta. Costs like housing, utilities, and transportation often vary, affecting the overall living expenses.

Greg Goad is a seasoned Realtor® based in Canton, GA, serving clients throughout Greater Atlanta and Northwest Georgia, including Cobb and Cherokee counties. As the founder of Goad Home Partners and an Elite Agent with Real Broker, LLC, Greg brings over 9 years of real estate expertise, more than $55 million in individual sales, and a reputation for integrity and client dedication.

Known for his deep Cartersville, GA knowledge, responsive service, and approachable professionalism, Greg expertly guides buyers, sellers, and relocating families through every step of the real estate process. Clients consistently praise his commitment, market insight, and genuine care, making him a trusted choice for anyone looking to buy or sell property in and around Cartersville, GA.