Essential Tips for a Buying a home Successfully

Buying a home for the first time can be both exciting and overwhelming, especially in a vibrant area like Cartersville, GA. Many things need to be considered to make the process go smoothly. Understanding the local real estate market and knowing where to find valuable resources can significantly ease the journey for new buyers.

Navigating the home buying process involves more than just finding the right property. It’s essential to be informed about financing options, local neighborhoods, and common pitfalls to avoid. Cartersville offers unique opportunities for first-time homebuyers, making it important to have a solid plan and the right information at hand.

With the right tips and guidance, first-time buyers can feel confident in their decisions. From securing financing to understanding the buying process, knowing where to focus can lead to a successful home purchase. Being well-prepared allows buyers to enjoy their new beginning in Cartersville with peace of mind.

Understanding the Cartersville, GA Real Estate Market

The real estate market in Cartersville, GA, is currently dynamic and offers various opportunities for first-time homebuyers. With rising home prices and a variety of property types, understanding the market can help buyers make informed decisions.

Overview of Housing Trends

In recent months, Cartersville has seen significant growth in home prices. As of June 2024, median home prices increased by 18.9%, reaching about $355,000. Homes typically sell quickly, with an average of 16 days on the market, down from 20 days the previous year.

The number of homes sold has slightly decreased, with only 28 transactions in June 2024 compared to 35 the same month last year. This trend indicates a competitive market, with buyers needing to act fast when they find a suitable property.

Price Ranges and Property Types

Cartersville’s real estate market offers various price ranges to suit different budgets. These can range from affordable starter homes around $200,000 to larger or more luxurious properties that can exceed $500,000.

Common property types include single-family homes, townhouses, and condos. First-time buyers should consider their needs, whether it’s a smaller space or a home with a yard.

Local Economy and Employment

Cartersville’s economy is steady and supports job growth. The area’s diverse industries include manufacturing, healthcare, and retail. This diversity provides job opportunities, making it an attractive location for potential homebuyers.

Many residents commute to nearby cities, which can be a convenient option for those seeking employment opportunities outside of Cartersville. Understanding the local job market can help buyers identify long-term living arrangements.

School Districts and Education

Education is a crucial factor in homebuying decisions for families. Cartersville is served by the Cartersville City Schools district, which includes several elementary, middle, and high schools.

The quality of education can vary between schools, so families should research specific institutions. Additionally, the presence of higher education options nearby can be an important consideration for many homebuyers.

Preparing for Homeownership

Preparing for homeownership involves several crucial steps. Buyers need to evaluate their financial situation, set a realistic budget, understand mortgage pre-approval, and recognize the impact of credit scores. Each of these factors plays a significant role in the home-buying process.

Assessing Your Financial Health

Before purchasing a home, it is essential for buyers to assess their financial health. This includes reviewing income, savings, and debts. A budget should be created that outlines all monthly expenses and income sources.

Calculating your debt-to-income (DTI) ratio is vital. This ratio helps determine how much a buyer can afford in monthly mortgage payments. A lower DTI indicates better financial health, making it easier to secure a loan.

Determining Your Budget

Once financial health is assessed, a budget must be established. Buyers should consider how much they can comfortably spend on a home. This includes the price of the home, taxes, insurance, and maintenance costs.

A practical approach is to use the 28/36 rule. This guideline suggests that no more than 28% of gross income should go to housing costs, while 36% should cover total debt payments. This ensures that buyers do not stretch their finances too thin and can manage their mortgage payments.

Understanding Mortgage Pre-Approval

Mortgage pre-approval is a crucial step in the home-buying process. It gives buyers a better understanding of how much they can borrow and shows sellers they are serious. To get pre-approved, buyers need to submit financial documents to a lender for review.

The lender will evaluate income, assets, and credit information. If approved, buyers receive a pre-approval letter, which outlines the loan amount, interest rate, and terms. This step simplifies the buying process and allows for quicker bidding on homes.

The Role of Credit Scores in Home Buying

Credit scores play a significant role in the home-buying process. They help lenders evaluate how risky a borrower may be. A higher credit score generally results in lower interest rates and better loan terms.

Buyers should aim for a score of at least 620, as many lenders require this minimum. If a score is lower, it may be wise to improve it before applying for a mortgage. Paying down debt, making payments on time, and correcting any errors on credit reports can enhance credit scores effectively.

Navigating the Buying Process

Buying a home involves multiple steps that can seem complex. Understanding key actions like choosing an agent, reviewing the importance of home inspections, making offers, and knowing closing costs can make the journey smoother.

Choosing a Real Estate Agent

Selecting a real estate agent is a crucial first step. A knowledgeable agent can provide valuable guidance throughout the buying process. They understand the local market in Cartersville, GA, helping buyers find properties that meet their needs.

Consider interviewing several agents. Ask about their experience, especially with first-time buyers. Check their track record of successful transactions in Cartersville. A good agent will listen to the buyer’s requirements and communicate openly about available options.

It’s also important to assess compatibility. Buyers should feel comfortable asking questions and discussing concerns. A strong agent-client relationship can lead to a more positive home-buying experience.

The Importance of Home Inspections

Home inspections are vital for identifying potential problems before finalizing a purchase. An inspector checks for issues like structural integrity, plumbing, and electrical systems. This assessment helps buyers make informed decisions.

Buyers should hire a qualified inspector, preferably one recommended by their real estate agent. The inspection typically lasts a few hours.

After receiving the inspection report, buyers may need to negotiate repairs with the seller. Understanding these issues can lead to better decisions and avoid costly surprises later. It’s an essential step for first-time buyers to safeguard their investment.

Making an Offer and Negotiating

Once a suitable home is found, the next step is making an offer. A real estate agent can help determine a fair offer price based on market conditions and comparable sales in the area.

The offer should include contingencies, such as financing and inspection clauses. This provides the buyer with protection if issues arise. Buyers should remain flexible during negotiations, as sellers might counter with different terms.

Good communication is key. The agent should facilitate discussions between the buyer and seller. Successful negotiations can lead to a satisfactory agreement that benefits both parties.

Closing Procedures and Costs

Closing is the final step in the home-buying process. It involves signing documents, transferring ownership, and paying closing costs. Buyers should be prepared for costs such as appraisal fees, title insurance, and attorney fees, which can total several thousand dollars.

Before closing, buyers should review all documents carefully. Understanding each document helps avoid surprises at the last minute.

It’s also advisable for buyers to conduct a final walkthrough of the property. This ensures that the home is in the agreed-upon condition. Being informed about these procedures helps create a smoother closing experience.

Finding the Right Property

Finding the right property in Cartersville, GA, requires careful consideration of several factors. First-time homebuyers should focus on identifying features that are essential for their lifestyle. Next, understanding resale value is important for long-term investment. Visiting homes and evaluating neighborhoods also play a crucial role in making a well-informed decision.

Identifying Must-Have Features

When searching for a home, buyers should start by listing their must-have features. These may include the number of bedrooms, bathrooms, and any specific amenities like a garage or backyard. Buyers need to be realistic about their needs versus wants.

They should consider whether they prefer a modern or traditional style, as well as any accessibility features if needed. Prioritizing these elements will streamline the search process and help buyers focus on properties that align with their lifestyle.

Considering Resale Value

Resale value is a critical consideration for first-time homebuyers. They should assess how the property will hold its value over time. Factors such as location, property condition, and nearby schools can greatly influence resale potential.

It’s wise to investigate market trends in Cartersville. Emerging neighborhoods might offer better growth opportunities. Buyers can also consult with local real estate experts to gauge the best investments.

Visiting Open Houses and Private Showings

Attending open houses and private showings is essential for buyers to experience properties firsthand. Open houses provide an excellent chance to view multiple homes in one day. This method helps in comparing different styles and layouts.

Private showings offer a more tailored experience where buyers can ask detailed questions. During visits, they should take notes and pictures to remember each property. Observing the property structure, lighting, and flow can also provide insights.

Evaluating Neighborhoods and Communities

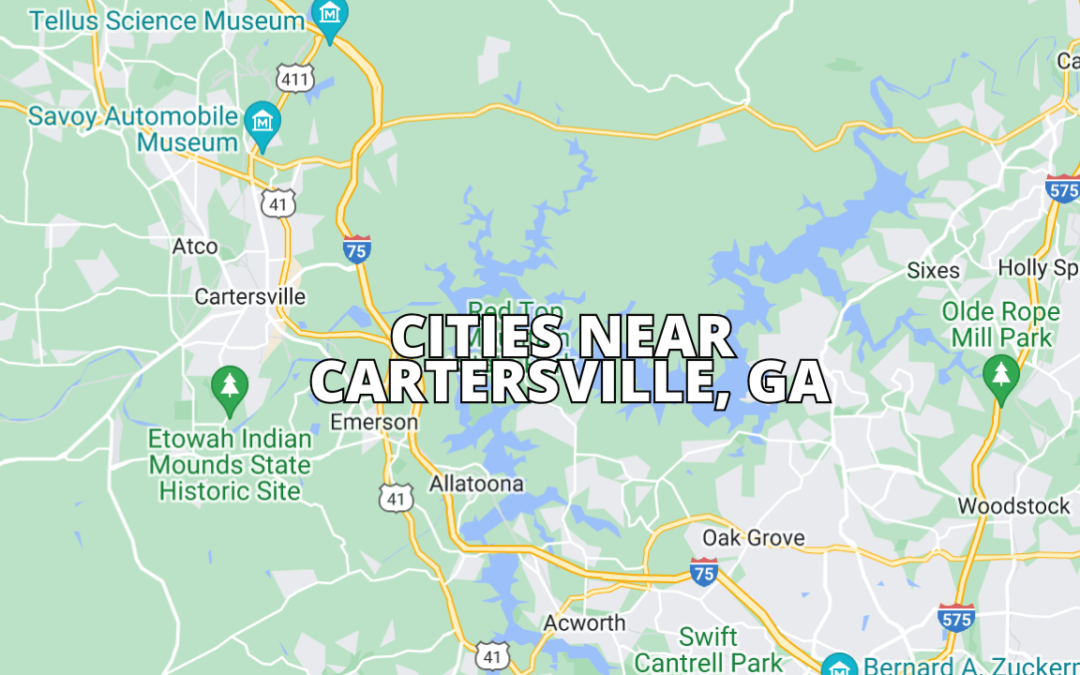

The neighborhood can significantly impact a buyer’s satisfaction with their new home. Investors should consider factors like safety, local amenities, and community services. Access to schools, parks, and grocery stores may be vital for family-oriented buyers.

Researching community engagement activities and local events can enhance the living experience. Walking or driving around the area at different times of day will help gauge traffic and noise levels. Buyers should aim to find a community that matches their lifestyle and values.

Understanding Legal and Regulatory Considerations

When buying a home in Cartersville, GA, it’s important to be aware of legal and regulatory factors that can impact the purchase. Understanding local zoning laws, regulations, and homeowners association guidelines can help prevent surprises down the line.

Local Zoning Laws and Regulations

Local zoning laws determine how land can be used within a community. In Cartersville, these regulations might specify residential, commercial, or mixed-use developments.

Buyers should check if the property is in a zone that aligns with their intended use. For example, if planning to run a business from home, knowing the zoning type is essential. Additionally, restrictions may exist regarding building heights, setbacks, and lot sizes.

Understanding these laws can prevent costly alterations or fines in the future. Buyers can consult the Cartersville zoning office or review local ordinances online for the most current information.

Homeowners Association (HOA) Guidelines

If the property is part of a homeowners association (HOA), it will be subject to specific rules and regulations. HOAs can manage the communal aspects of a neighborhood, like landscaping, community amenities, and noise restrictions.

It’s crucial for buyers to review the HOA bylaws and fees before making a purchase. These documents will outline what is expected from homeowners and the trade-offs of living in that community.

Potential homeowners should inquire about any upcoming assessments or projects that may affect fees. By understanding these guidelines, buyers can ensure they’re comfortable with the community’s standards and lifestyle.

Securing Financing

Securing financing is a critical step for first-time homebuyers in Cartersville, GA. Understanding different loan types and terms can lead to better financial decisions. Knowledge about down payments and private mortgage insurance (PMI) is also essential for budgeting.

Comparing Loan Types

Homebuyers have several options when it comes to loans. The most common types include Conventional, FHA, and VA loans.

- Conventional loans usually require a higher credit score. They often need a down payment of at least 3%.

- FHA loans are backed by the Federal Housing Administration. They are more flexible and allow for lower credit scores, needing a down payment as low as 3.5%.

- VA loans are available for veterans and active-duty military members. They require no down payment and have competitive interest rates.

Each loan type comes with different benefits and requirements. It is vital for buyers to evaluate what suits their financial situation best.

Negotiating Loan Terms

When it comes to negotiating loan terms, homebuyers can be proactive. Key terms to discuss include interest rates, closing costs, and the length of the loan.

- Interest rates can significantly affect monthly payments. Buyers should shop around to find competitive rates.

- Closing costs typically include fees for appraisal, inspection, and title services. Buyers can ask the lender for a breakdown of these costs.

- The length of the loan (usually 15 or 30 years) affects the monthly payment and total interest paid. Buyers may choose shorter terms for possible savings.

Having a clear idea of what to negotiate can lead to better terms.

Locking in Interest Rates

Locking in an interest rate is a crucial step in the financing process. By locking in the rate, homebuyers protect themselves from rate increases during the mortgage approval process.

Typically, borrowers can lock a rate for 30 to 60 days. Some lenders offer extended locks up to 90 days.

A rate lock can safeguard against market fluctuations. However, if rates drop, the borrower might end up with a higher rate than necessary. Therefore, buyers should monitor market trends closely.

Understanding Down Payments and PMI

Down payments are a significant part of the home purchasing process. They are typically expressed as a percentage of the home’s purchase price.

A 20% down payment can eliminate the need for private mortgage insurance (PMI), which is an added monthly expense. However, many first-time buyers might not have this amount saved.

For those who put down less than 20%, PMI usually ranges from 0.3% to 1.5% of the original loan amount per year. Buyers should factor this into their financing plans, as it affects overall affordability. Understanding these elements is vital for successful homeownership.

Planning for Additional Expenses

Buying a home involves costs beyond the purchase price. It’s important for first-time homebuyers in Cartersville to plan for ongoing expenses that can affect their budget.

Maintenance and Repair Costs

Homeownership comes with a range of maintenance and repair responsibilities. Over time, items such as roofs, plumbing, and HVAC systems may need attention and repairs.

Typical Maintenance Costs:

- Regular maintenance: About 1% of the home’s value annually.

- Emergencies: Setting aside funds for unexpected repairs can save homeowners from financial strain.

Buyers should keep in mind the age of the home. Older homes might require more frequent repairs. Creating a maintenance schedule can help manage these costs efficiently.

Property Taxes and Homeowner’s Insurance

Property taxes in Cartersville are based on the home’s assessed value. Homebuyers should research current rates to estimate future tax payments.

Insurance Considerations:

- Homeowner’s Insurance: This typically costs between $800 and $1,500 annually.

- Flood Insurance: Depending on the property’s location, additional flood insurance may be necessary.

These taxes and insurance costs can increase over time. Thus, being proactive in budgeting is key.

Utilities and Other Living Expenses

Utility costs can vary greatly based on the size of the home and energy efficiency. Common utilities include water, electricity, and gas, which can add up quickly.

Average Monthly Utility Costs:

- Electricity: $100 – $200

- Water: $50 – $100

- Gas: $50 – $150

Beyond utilities, homeowners should consider costs for yard maintenance, internet, and any homeowners association (HOA) fees if applicable. Planning these expenses will provide a complete picture of living costs in Cartersville.

Moving and Settling In

Moving to a new home is a significant step for first-time buyers. It involves careful planning and an understanding of what to expect in the new community.

Hiring Movers vs. DIY Moving

When deciding how to move, buyers should weigh the pros and cons of hiring professional movers against doing it themselves. Hiring movers can save time and effort. Professional services often include packing, loading, and unloading, easing much of the physical stress. The cost can be high, but it may be worth it for those who prefer convenience.

On the other hand, DIY moving can be more cost-effective. It allows for personal control over the entire process, from packing to transport. It may also provide a sense of accomplishment. However, it requires significant physical effort and time. Buyers must consider their budget and the amount of help available when making this choice.

Setting Up Essential Services

Once the move is complete, the next step is establishing essential services. This typically includes arranging for utilities like electricity, water, gas, and internet.

Buyers should contact local providers to ensure services are activated before moving day. Many companies allow online account setup for convenience. It’s also wise to schedule trash and recycling pickup.

Creating a checklist can help streamline this process. Simple steps like ensuring all bills are paid and confirming installation times will help avoid service interruptions.

Getting to Know Your New Community

Familiarizing oneself with the new community can make settling in easier. Buyers should explore local amenities such as grocery stores, schools, and parks.

Joining community groups, attending local events, or visiting the library can also provide helpful insights. First-time homebuyers can meet neighbors and build a support network. Learning about local regulations, parks, and schools can further enhance the moving experience.

Buyers can also take advantage of local resources like city guides or social media groups to connect with others in Cartersville. Finding favorites spots can help them feel at home more quickly.

Considering buying a home in Cartersville, Georgia?

Take the first step today! Book a call with our real estate advisors today!

Greg Goad is a seasoned Realtor® based in Canton, GA, serving clients throughout Greater Atlanta and Northwest Georgia, including Cobb and Cherokee counties. As the founder of Goad Home Partners and an Elite Agent with Real Broker, LLC, Greg brings over 9 years of real estate expertise, more than $55 million in individual sales, and a reputation for integrity and client dedication.

Known for his deep Cartersville, GA knowledge, responsive service, and approachable professionalism, Greg expertly guides buyers, sellers, and relocating families through every step of the real estate process. Clients consistently praise his commitment, market insight, and genuine care, making him a trusted choice for anyone looking to buy or sell property in and around Cartersville, GA.